In today’s saturated, fast-moving consumer goods (FMCG) markets, premiumization has emerged as a key strategy for brands seeking growth and higher margins. This article examines how marketing can successfully drive consumer acceptance of value-added, premium-priced products. We explore premium branding strategies and consumers’ willingness-to-pay, with examples from premium bakery, dairy, and traditional foods like dates transformed into luxury offerings. Finally, we distill key marketing lessons on communicating premium value to consumers.

Keywords: premiumization, consumer willingness-to-pay, fast-moving consumer goods, FMCG, value-added products, brand equity, marketing strategies.

Introduction

Premiumization — the move towards offering higher-quality products at higher price points — has become a major trend in the FMCG sector worldwide [6], [10]. As growth in many mass categories slows, companies are «doubling down on opportunities in premiumization» to boost profit margins and cater to consumers who are willing to pay more for superior quality, convenience, or brand prestige [6]. Notably, sales of «premium tier» FMCG products (those priced at least ~20 % above category average) have been rising faster than overall category growth in many markets [10]. For example, in Southeast Asia the premium segment grew 21 % between 2012 and 2014, more than double the growth of mainstream and value-tier products. This reflects a «taste of the good life» spreading beyond just affluent elites — even as economic pressures persist, a significant segment of consumers across income levels seek out value-added products that promise enhanced quality or experience [6], [10].

However, commanding a price premium is no simple task. Consumers today are value-conscious and won’t pay more just for a brand name or higher price tag alone [10]. Successful premiumization requires carefully crafted marketing to communicate a clear value proposition — whether it’s exceptional quality, performance, taste, health benefit, or emotional gratification. As this article will discuss, brands must align product innovation with consumer aspirations and effectively tell the story of premium value. We will examine what «premium» means to consumers and how it influences willingness-to-pay, review strategies companies use to position and market premium FMCG offerings, highlight case examples from bakery, dairy, and date products, and distill key lessons for marketers on building acceptance of premium-priced goods.

Understanding Premiumization in FMCG

Premiumization refers to a strategy of upgrading products and brands to a higher perceived value, allowing a higher price point. In practice, this often means introducing high-quality or exclusive product versions that target consumers willing to pay extra for «enhanced experiences, better quality, or added convenience.» [6] For example, a basic soap might be replaced by a luxe body wash at several times the price, promising superior ingredients and sensory appeal. By innovating around new features, refined formulations, upscale packaging, or even novel formats, brands aim to differentiate premium offerings from standard ones.

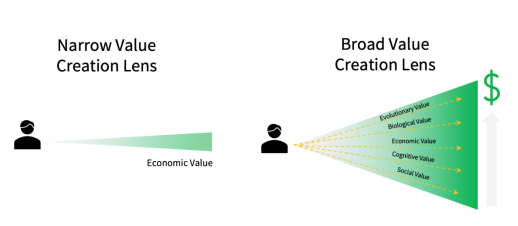

Importantly, true premiumization is not just about raising prices — it’s about delivering greater value that consumers can perceive Figure 1 [8]. A global Nielsen survey found that only 31 % of consumers define a product as «premium» simply because it’s expensive [10]. In contrast, the most common mark of a premium product (cited by 54 % of respondents worldwide) was «made with high-quality materials or ingredients,» followed by superior function or performance (46 %). In other words, consumers expect a premium-priced good to earn its higher cost through tangible quality improvements. Other factors like design and style (38 %) or a well-known brand name (38 %) also contribute to premium perceptions, especially in emerging markets where owning aspirational brands confers status [10]. As one analyst noted, in many developing markets consumers are attracted to premium brands as symbols of having «achieved a certain level of success,» while also trusting established brand names as a guarantee of quality so they don’t waste money on a product that disappoints. Thus, premiumization is closely tied to brand trust and quality signaling.

Fig. 1. Expanding the Lens for Customer Value Creation

From a business perspective, premiumization has been a critical driver of value growth in the past decade. When economic conditions were favorable, many FMCG brands grew revenue by encouraging trade-up to premium tiers [12]. Even now, with cost-of-living concerns pressuring some consumers to «trade down,» wealthier segments continue to seek premium products — creating a polarized market. This puts a premium on balanced portfolio strategy: companies often maintain entry-level options for price-sensitive shoppers, while expanding premium lines for those willing to spend more [12]. For example, in India, Dabur offers small, affordable sachet packs of its high-end products to recruit rural consumers with rising aspirations but lower incomes [6]. This way, brands can capture premium demand without alienating value-focused shoppers. In summary, premiumization in FMCG is about creating and communicating enhanced product value — through quality, innovation, brand prestige or experience — to justify higher price points and build deeper consumer loyalty.

Consumer Willingness-to-Pay for Premium Value

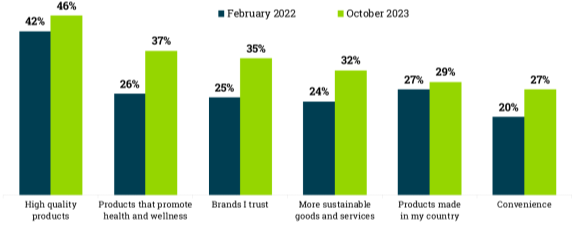

Consumers’ willingness-to-pay (WTP) for premium FMCG products depends on the perceived value they get in return. Research shows that many consumers are willing to pay a price premium when certain conditions are met. Quality is paramount: a global EY survey found the number one reason people pay more is higher product quality Figure 2 [7]. In Nielsen’s study, more than half of Millennials worldwide said they were «highly willing to pay a premium» for products that have high quality standards, significantly more than older generations [10]. Likewise, brand trust and loyalty strongly influence WTP. A 2025 consumer survey reported that over two-thirds of consumers in the US, UK, and Australia would pay on average 25 % more for products from their favorite brands [2]. These loyal shoppers stick with trusted brands even if prices «skyrocket,» so long as the brand continues to deliver consistent quality and a positive experience.

Fig. 2. Product features for which consumers will pay a premium (% share of consumers willing to pay extra for certain features)

Beyond rational evaluations of quality or trust, emotional and lifestyle factors also drive willingness-to-pay. Buying a premium product often provides psychological rewards: in Nielsen’s survey, 52 % of consumers agreed that purchasing premium products makes them feel good, and 50 % said it makes them feel more confident [10]. Consumers use premium purchases as a form of self-reward or to reinforce a desired self-image. This is evident in the food and beverage space, where shoppers describe premium treats as small «affordable luxuries» that brighten their day. «People are willing to pay for a premium product in order to take a break… unwind and savor what they love,» explains one marketing expert, noting that a high-end snack or drink can turn an ordinary moment into something special [4]. Even when budgets tighten, many opt to forgo big-ticket luxuries but still indulge in premium FMCG goods as a substitute — e.g. splurging on gourmet foods when dining out is too expensive. This phenomenon of «trading down to trade up» means premium grocery brands can thrive in economic downturns by capturing consumers’ desire for a bit of luxury at home [4].

Crucially, consumers must perceive real value to justify paying more. They are quick to recognize when a higher price isn’t warranted. Less than one-third globally say a product is premium because it is expensive [10] — a warning to brands that simply inflating price without clear value improvements will not win acceptance. Instead, successful premium brands communicate specific benefits: e.g., using organic or rare ingredients, superior craftsmanship, authentic heritage, or advanced functionality. In fact, 42 % of global consumers are willing to pay a premium for products made with organic or all-natural ingredients [10], reflecting the appeal of health and quality cues. Similarly, amid rising sustainability awareness, four out of five consumers say they would pay more for sustainably produced goods, in one 2024 survey, shoppers globally indicated an average willingness to spend 9.7 % more for products with strong environmental credentials [11]. All these signals — whether «organic,» «eco-friendly,» «handcrafted,» or «limited edition» — serve to justify the premium in the consumer’s mind by aligning with their values or desires.

In summary, consumers will pay extra when they believe they are getting extra. High quality, trusted brands, and positive experiences are the foundational drivers. On top of that, emotional fulfillment (indulgence, status, wellness, nostalgia) plays a key role in tipping the scales toward a premium purchase. Marketers need to identify which value drivers resonate with their target segment — be it quality, health, sustainability, exclusivity, or simply the joy of a great product — and highlight those in messaging. When the perceived value outweighs the price difference, consumers readily accept premium prices.

Marketing Strategies for Premiumization in FMCG

Implementing premiumization requires a holistic marketing approach that elevates the product’s perceived value. Below are key strategies brands use to successfully market premium FMCG offerings:

Deliver Real Quality Upgrades: The foundation of premium positioning is superior product quality. This could mean using better ingredients (e.g. single-origin cocoa in chocolate, organic dairy in yogurt), investing in craftsmanship, or improving functionality. Since «premium» in consumers’ eyes is defined by exceptional quality and performance [10], marketers must ensure the product experience clearly outshines standard alternatives. For example, when Greek-style yogurt was introduced, its creamier texture and higher protein redefined premium yogurt by delivering a tangible improvement over regular yogurt [4]. Similarly, in ice cream, brands upping the butterfat content and using all-natural ingredients created an ultra-rich product that consumers perceive as worth a higher price. In short, product innovation is core — companies should add novel flavors, healthier formulations, or enhanced features that genuinely justify a premium (what one consultant calls the «more innovation» path to premiumization [9]).

Enhance Packaging and Design: Visual and tactile cues significantly influence premium perception. Premium brands invest in high-end packaging design, materials, and branding that signal exclusivity. A nicely designed bottle, an artistic label, or a luxurious box can make a product feel more upscale (for instance, premium bottled waters justify their markup partly through elegant packaging and branding) [9]. Nielsen’s global research noted that superior design or style was cited by 38 % of consumers as a defining trait of premium products [10]. Everything from color schemes to font choices to the heft of a container can send a message of quality. Thus, marketers should treat packaging as an integral part of the value proposition — as a «silent salesman» of premium quality on the shelf. Limited edition or gift-style packaging can also create a sense of specialness that encourages consumers to pay more for the experience of ownership.

Craft a Compelling Brand Story: Brand storytelling and heritage can elevate a product’s perceived value beyond its functional attributes. Especially in categories with rich traditions (coffee, tea, spirits, confectionery, etc.), weaving narratives of origin, artisanal production, or brand legacy helps create an aura of premium authenticity. For example, a brand might highlight that its product is crafted in small batches by expert makers, or sourced from a famed region (think single-origin coffee or estate tea). In the Middle East, dates have long been a humble staple, but one company (Bateel) transformed them into a luxury item by leveraging heritage and story: positioning itself as a pioneer from Saudi Arabia that grows the finest dates and presents them as gourmet delicacies [3]. By emphasizing traditions, authenticity, or a founder’s passion, marketing can create an emotional connection and a sense of exclusivity around the premium product.

Leverage Aspirational Imagery and Emotions: Premium brands often tap into consumers’ deeper desires for status, self-indulgence, or self-improvement. Advertising and messaging for premium products commonly use aspirational imagery — depicting a desirable lifestyle or identity that the consumer can access by buying the product. For instance, premium personal care items might be marketed with images of spa-like pampering, suggesting the buyer is treating themselves to the best. In food marketing, terms like «gourmet,» «artisanal,» or even taglines like «you deserve this» explicitly invite consumers to indulge. As one industry observer noted, many new premium dairy launches make a point in their marketing to announce «I’m extra special and you deserve it» [4]. This kind of communication appeals to consumers’ emotional drives — whether it’s the need to feel unique, sophisticated, or rewarded — thereby justifying the premium on an emotional level. Storytelling that connects the product to an elevated experience (e.g., enjoying a cup of single-origin coffee on a leisurely morning, versus a run-of-the-mill caffeine fix) can widen consumers’ willingness-to-pay.

Focus on Perceived Value, Not Just Cost: Traditional pricing logic says higher price might deter buyers, but behavioral marketing turns that on its head by enlarging perceived value. One framework suggests five routes to boosting perceived value without radically increasing cost: make the choice feel like a «safe bet,» make it easier (more convenient), add innovation, create a memorable experience, and enhance the consumer’s image [9]. These principles correspond to reassurance, convenience, novelty, experiential appeal, and status — each of which can make a product more attractive at a premium. For example, offering a «safe bet» could mean emphasizing a money-back guarantee or trusted certification (easing risk aversion), while «enhance image» might involve prestige branding or influencer endorsements that make owning the product feel cool. By systematically identifying such value enhancers, marketers can effectively bend the rules of pricing and get consumers to pay more than classical economic models would predict [9]. The key is to understand that value is perceived, in the mind of the customer, and to design marketing programs that amplify the intangibles (brand aura, convenience, experience) that people cherish.

Segmentation and Tiered Offerings: A smart premiumization strategy often involves tiering your product line to cater to different willingness-to-pay segments. Companies may introduce good-better-best versions or sub-brands — for instance, a standard line, a premium line, and perhaps an ultra-premium or limited edition line for the top end. Each tier targets a specific segment: one aiming for mass affordability, another for «middle-class» indulgence, and the highest for connoisseurs or status-seekers. This way, marketing can be tailored: value messaging for the entry level, vs. prestige and exclusivity for the top tier. Such price-pack architecture ensures you capture consumers who are ready to spend more, without losing those who aren’t [12]. One classic example is the beverage industry: many beer and soda brands have an economy offering, a flagship product, and a craft or imported premium offering — each with distinct branding. In emerging markets, as noted earlier, brands also use packaging size to segment, smaller packs of premium goods allow lower-income consumers to aspire within their budget, while larger deluxe packages cater to affluent buyers [6]. The marketing challenge is to maintain consistency (so that the premium tier still feels part of the brand family) while clearly differentiating the extra value that comes with moving up tiers.

Communicate a Clear Value Proposition: Above all, marketing communications for a premium product must clearly answer the customer’s question: «What am I paying extra for?». Whether through advertising, in-store messaging, or packaging copy, the premium value proposition should be front and center. For example, if a new premium juice is priced higher because it’s cold-pressed and has no additives, the label and ads should emphasize «100 % cold-pressed, never from concentrate, no sugar added» — highlighting the purity and craftsmanship. If a premium snack charges more because of exotic ingredients, the marketing might focus on the unique origin or superior taste. It sounds obvious, but it’s a point worth stressing: companies sometimes err by relying on a fancy image or high price alone, without explicitly conveying the concrete benefits. As Nielsen’s analysts warned, if you push up prices without a «very clear value proposition to support the change,» consumers will balk [10]. Thus, successful premium brands educate consumers about what makes their product different and better. This includes leveraging reviews, demonstrations, or certifications (like awards won, or expert endorsements) as proof of superior value. Educated consumers who appreciate the difference are more likely to accept the premium.

By combining these strategies — genuine quality improvements, upscale design, emotional branding, value-focused messaging, and smart segmentation — FMCG marketers can create an ecosystem that supports premiumization. Next, we look at how these principles come to life with concrete examples in three product categories.

Premiumization in Action: Case Examples Premium Bakery Products: The Rise of Indulgent Breads

One striking example of premiumization is the bakery category, where even a staple like bread has been successfully premiumized. In recent years, brioche-style breads — enriched with butter, eggs, and a soft, indulgent texture — have surged in popularity as an upscale alternative to ordinary loaves. Industry data from 2023 showed that brioche products had the strongest growth in the premium bread segment, outpacing other options like pretzel buns [13]. Traditional center-aisle bread sales have been relatively flat or declining in volume, but brioche’s rise has infused new value into the category. Melissa Altobelli, a bakery market analyst, noted «brioche actually has the strongest unit and dollar growth rate of the premium options. It’s here to stay. It’s trendy. It’s versatile.» [13]. This trend reflects consumers’ willingness-to-pay more for an upgraded sensory experience in everyday foods. A standard white bread might be $2, while a brioche loaf can command $5 or more — yet shoppers are buying the latter for its rich flavor and texture (perhaps to elevate their breakfast or make more indulgent sandwiches).

Bakery brands have capitalized on this by launching premium lines and innovating within the trend. For instance, Grupo Bimbo, one of the world’s largest bread companies, acquired a UK-based specialty baker (St. Pierre) famed for its brioche products, signaling confidence that the «brioche boom» will drive growth. Bimbo also introduced brioche under its mainstream brands in the US, bringing a gourmet-style product to mass retail [13]. The marketing around these products highlights their French heritage, use of butter (versus oil in regular bread), and melt-in-your-mouth softness — all cues of quality and indulgence. Premium positioning in bakery also taps into nostalgia and authenticity. According to one commercial bakery executive, «nostalgic flavors are back… we call it mindful indulgence», noting that consumers find comfort and reward in classic, high-quality baked goods. By offering «indulgence in a wholesome form,» premium breads like brioche or artisan rye allow consumers to treat themselves within a daily staple [13]. The lesson from bakery is that even low-tech categories can be premiumized by improving ingredients and positioning the product as a small luxury that makes routine eating more enjoyable.

Premium Dairy Products: Health Meets Indulgence

The dairy aisle provides a rich study in premiumization, as brands have introduced both better-for-you and decadent premium options to appeal to different consumer desires. On the one hand, health-focused innovations command a premium — for example, high-protein Greek yogurts, lactose-free or A2 milk (for easier digestion), and organic dairy lines. Greek yogurt, which took off in the 2010s, was significantly more expensive than regular yogurt, yet gained huge market share by delivering a thicker texture, higher protein content, and a perception of authenticity (often packaged in earthy, minimalist cups). As one dairy scientist noted, «‘premium’ was completely redefined [by Greek yogurt] as products were formulated with higher dairy solids… translating into creamier textures» [4]. Consumers were willing to pay extra for this quality upgrade and the exotic appeal of a Mediterranean diet item. Similarly, many are willing to pay a price premium for organic or grass-fed milk due to perceived health and taste benefits — studies indicate some consumers pay ~10 % more for grass-fed dairy products versus conventional [5].

On the other hand, indulgent premium is equally important in dairy. Ice cream is a prime example: «premium» ice cream in consumer terms usually means a denser product with higher butterfat and luxurious ingredients (think Häagen-Dazs or Ben & Jerry’s). «Consumers tend to believe that premium [ice cream] should be dense with higher-fat content… using higher-quality ingredients,» an industry expert explains [4]. Super-premium ice creams often come in smaller pint packaging and at double or triple the price per unit of basic ice cream, yet their brands thrive by marketing the product as a decadent treat worth savoring. Likewise, artisan cheeses, gourmet butter, and other dairy products with unique provenance (e.g., European appellation cheeses, or small-batch local farm cheeses) carry a hefty premium, supported by storytelling about tradition and craft.

Interestingly, clean-label and simplicity are also premium cues now in dairy. Consumers increasingly equate «fewer ingredients and all-natural» with higher quality. «Premium is defined as meeting stringent ingredient label declarations… use of natural flavors and colors,» notes one marketing manager, who adds that a simple, clean label can signal that a product is purer and thus worth more [4]. For instance, an old-fashioned glass-bottled milk with just «milk» as the ingredient might be positioned as a premium farm-fresh offering, leveraging nostalgia and purity. The marketing challenge is to balance healthful premium and indulgent premium. Many dairy brands manage to do both: they offer lines that are indulgent (extra creamy, dessert-like) and lines that are fortified or ethical (protein-enriched, or from humanely treated cows), each at premium price points. Notably, consumers are willing to pay more in both cases — «for health benefits and for an indulgent treat. They each have their place.» The unifying theme is that the product delivers «a more enjoyable experience» — either you feel better about its nutrition or you revel in its superior taste [4]. Effective premium-dairy marketing emphasizes whichever benefit is relevant: a Greek yogurt brand might focus on authenticity and protein (often with imagery of Greek islands or happy cows), whereas a gelato might highlight its Italian heritage and rich flavor with tantalizing visuals. By aligning product attributes with consumer values (wellness, pleasure, authenticity), dairy brands have successfully created premium sub-categories that command higher loyalty and margin.

Elevating a Commodity: Dates as Luxury Gifts

One of the most illuminating examples of premiumization comes from an unlikely product: dates. Traditionally, dates are an inexpensive staple fruit in the Middle East, often sold in bulk with minimal packaging. Yet, through savvy branding and marketing, they have been transformed into a luxury gourmet item. The pioneer in this space is Bateel International, a Saudi-based company that has repositioned dates as the «Louis Vuitton» of fruit by focusing on top-end quality and an upscale experience. Bateel grows select organic date varieties and sells them in elegant boutiques alongside fine chocolates and gifts. The dates themselves are enhanced into value-added products — for example, hand-stuffed dates with premium nuts and candied fruits, chocolate-coated dates, date-infused condiments, and even sparkling date drinks. By doing so, Bateel turns a simple fruit into a diverse delicacy lineup [3].

The marketing of these premium dates centers on heritage, craftsmanship, and exclusivity. Bateel leverages its origin story as a historic date farm in Saudi Arabia and emphasizes that it controls the process «from tree to table,» ensuring unmatched quality. The dates are presented in gorgeous gift boxes (lacquered wood, ornate designs) akin to boxes of fine chocolates, signaling that they are gift-worthy and luxurious. As a result, consumers are willing to pay astonishing premiums — a Bateel gift box of dates can sell for dozens or hundreds of dollars, whereas ordinary dates cost only a few dollars per kilo. Clearly, what the customer buys is not just the fruit, but the experience and prestige of a gourmet product. «Bateel’s product strategy transcends traditional dates, repositioning them as premium ingredients in gourmet offerings,» notes one analysis, highlighting items like «stuffed dates with pistachios, dark chocolate-coated varieties, and artisanal date vinegar» aimed at affluent, health-conscious buyers [3]. By aligning the product with the global trend for exotic, healthy luxuries and by meeting high standards (organic, beautifully packaged), they’ve tapped into a broadening demand: even internationally, consumers in cities like London or Seoul are intrigued by this «Middle Eastern delicacy» presented as a modern luxury [1].

The success of premium dates underscores a key marketing lesson: any product can potentially be premiumized with the right value proposition and positioning. Bateel identified that dates are nutrient-rich and culturally significant — a great story to tell — and built a premium brand around making them aspirational. Their boutiques are akin to patisseries or wine shops, where staff educate buyers on flavor notes of different date varieties. In essence, they created a culture of connoisseurship around a commodity. Other date brands have since followed suit with upscale offerings, but Bateel’s head start and partnership with luxury conglomerate LVMH (which has a stake in the company) have solidified it as a leader [3]. For marketers, this case illustrates the power of differentiation and storytelling in premiumization: by focusing on provenance, quality, and gifting experience, one can elevate a product far beyond its commodity status.

Key Marketing Lessons on Communicating Premium Value

The above examples and strategies yield several overarching lessons for marketers seeking to drive acceptance of premium, value-added products:

- Always Tie Price to Clear Value: Ensure that any premium pricing is backed by concrete and communicated product benefits. Never assume consumers will «get it» — explicitly highlight why your product is superior. Whether it’s a unique ingredient, a craftsmanship detail, or a performance advantage, make that the hero of your messaging. Remember that only a minority of consumers equate high price alone with premium [10]. Just as Nielsen’s global study showed quality and function are top premium attributes, your marketing should continually reinforce the quality/performance story to justify the cost. For example, if you charge more for a premium juice because it’s cold-pressed, educate consumers about what cold-pressed means for taste and nutrition.

- Build Trust and Credibility: Trust is the currency that lets brands command premiums over generic alternatives. Invest in brand-building and consistency so that consumers know they can rely on your product. Positive reviews, word-of-mouth, and consistent product quality over time all strengthen the trust factor. Communicate your brand’s expertise (years in business, awards won, certifications) to reassure buyers that the premium choice is a safe bet that won’t disappoint [9]. In premium sectors, consider offering guarantees or trials — for instance, a high-end skincare brand might offer a money-back guarantee to reduce the risk perceived by a first-time buyer. Trust also involves transparency: many premium brands use storytelling and even supply chain transparency (e.g. farm-to-table narratives, sourcing videos) to show they have nothing to hide and everything to boast about.

- Engage Emotions and Aspirations: Marketing premium products is as much about how the consumer feels as what they rationally think. Craft campaigns that tap into aspirational emotions — the feeling of self-indulgence, improved status, or participating in an exclusive experience. Consumers often justify premium purchases post hoc by saying «it makes me feel good/confident» [10], so give them reasons to feel that way. Luxury and premium communications traditionally excel at this by using imagery of happy, sophisticated people enjoying the product in beautiful settings. Even for less glamorous products, find the emotional angle: a premium eco-friendly cleaner might make the buyer feel responsible and proud of supporting sustainability, which is an emotional reward. Storytelling can be very effective here — for instance, sharing the artisan’s story behind a product can create an emotional bond and a sense of participating in something meaningful, beyond just a transaction.

- Use Premium Cues Consistently: Every touchpoint should consistently signal premium quality. This goes beyond ads to include packaging, retail displays, website experience, and customer service. Premium cues include things like elegant design, rich imagery, sophisticated language, and attentive service. A disjointed experience (e.g., a high price but cheap-looking packaging, or luxury claims but poor customer support) will undermine credibility. Consistency builds an overarching impression of quality. For example, Apple famously commands price premiums in consumer electronics — not just due to product features, but because the entire brand experience (product design, packaging that unfolds like a gift, sleek stores, helpful staff) reinforces a premium image. In FMCG, a gourmet food brand might use heavyweight jars, metallic accents on labels, and provide recipes and pairing tips via a QR code — all adding to the sense that this is not a run-of-the-mill item. Small details matter in convincing consumers that they are getting added value for the added cost.

- Educate and Offer Trial to Reduce Barriers: Despite interest in premium products, some consumers hesitate due to uncertainty («Will it really be that much better?»). Marketing should aim to reduce this uncertainty. Education is one route (as mentioned, explaining the value), but equally important is allowing consumers to experience the difference. This could be through in-store sampling, smaller trial sizes, or introductory promotions. Many premium launches use sampling campaigns — for instance, offering bites of a premium brioche or sips of a premium juice at grocery stores, so consumers can immediately sense the upgrade in taste or quality. Once they’ve tried and enjoyed it, they are more likely to justify the purchase. Additionally, leveraging early adopters and reviews can help, encourage satisfied premium customers to share testimonials about how the product is worth the extra money, as peer affirmation can sway others. Essentially, lower the psychological risk of trying a premium product.

- Balance Premium and Accessibility: A final lesson is strategic rather than tactical: successful premiumization doesn’t mean abandoning all value-conscious consumers. The most resilient brands manage a portfolio that ranges from mass to premium, or they find ways to ladder consumers up gradually. By offering entry-level versions or smaller pack sizes at lower absolute prices, you keep the brand within reach, preventing would-be customers from defecting to cheaper competitors entirely. Then, use marketing to entice those consumers to aspire upward when they can. For example, an FMCG brand might advertise its top-tier product as the «ultimate treat» while still advertising its core product as an everyday staple — thus maintaining broad appeal. This dual strategy was seen in the rural vs. urban tactics in emerging markets: companies introduced premium products but in mini formats to rural shoppers [6], essentially seeding the taste for premium even among lower-income segments. In developed markets, we see something similar with «affordable luxury» sub-brands (e.g., a premium ice cream brand selling single-serving bars at $2 each, making it easier for more people to try). Marketing segmentation ensures that premiumization contributes to brand equity and profit without overly narrowing your customer base.

- Premiumization Can Boost Loyalty: When done right, premiumization not only drives short-term revenue but can deepen customer loyalty. Consumers who trade up often develop a stronger attachment to the brand, having «invested» more in it. They also appreciate the brand for offering them something special. For instance, one report noted that premiumization helps companies build stronger brand loyalty among consumers, in addition to higher margins [6]. This implies a virtuous cycle: a loyal customer is less price-sensitive and more likely to advocate for the brand, which in turn can justify maintaining premium pricing. Marketers should leverage this by nurturing premium customers — e.g., through exclusive clubs, early access to new premium releases, or personalized communications — to reinforce that sense of receiving added value. By treating premium buyers as VIPs, brands can solidify their willingness-to-pay over the long term.

Conclusion

In conclusion, premiumization in FMCG is a powerful strategy for brands to differentiate themselves and drive growth, but its success hinges on savvy marketing. By thoroughly understanding what motivates consumers to pay a premium — superior quality, trust, emotional gratification, status, and more — marketers can craft value propositions that resonate. The cases of brioche bread, premium dairy, and gourmet dates demonstrate that with the right product enhancements and storytelling, even familiar products can be reimagined as premium offerings that consumers eagerly embrace. The key is to communicate value at every step: aligning price with quality, engaging consumers’ senses and emotions, and reinforcing the brand’s premium positioning consistently.

Ultimately, premiumization is about creating a win-win: consumers feel they are getting a significantly better product or experience, and companies earn better margins and loyalty. As the consumer landscape evolves, with younger generations accustomed to «trading up» in categories from coffee to cosmetics, premiumization will continue to be a relevant strategy. Marketing professionals and brand managers should take these lessons to heart — success lies not in simply charging more, but in convincing customers that it’s worth paying more. When marketing drives home that message effectively, premium products can flourish even in competitive or cost-conscious markets, elevating both the brand and consumer satisfaction to new heights.

References:

- Arab News. (2024, December 9). Bateel expands into South Korea with luxury boutique. Arab News. Retrieved June 13, 2025, from https://arab.news/9dyu2

- Brady, M. (2025, April 22). Most consumers will pay 25 % more for their favorite brands, survey finds. CX Dive. Retrieved June 13, 2025, from https://www.customerexperiencedive.com/news/consumers-pay-more-favorite-brands-survey/745586/

- Carter, P. (2025, April 13). Bateel International’s ambitious expansion: A luxury play rooted in Saudi heritage. AInvest Fintech Inc. Retrieved June 13, 2025, from https://www.ainvest.com/news/bateel-international-ambitious-expansion-luxury-play-rooted-saudi-heritage-2504/

- Decker, K. (2016, February 10). Inclusions can boost premium aspect for dairy products. Dairy Foods. Retrieved June 13, 2025, from https://www.dairyfoods.com/articles/91608-inclusions-can-boost-premium-aspect-for-dairy-products/

- Esene, F. E. (2023). Consumers’ preferences and willingness to pay for value-added dairy products in Kentucky: Considering price, provenance, and environmental product attributes (Master’s thesis, University of Kentucky). Retrieved June 13, 2025, from https://uknowledge.uky.edu/agecon_etds/106/

- MANI. (n.d.). FMCG Companies Bet on Premiumization: What It Means for Consumers and Investors. Our Wealth Insights. Retrieved June 13, 2025, from https://ourwealthinsights.com/fmcg-companies-bet-on-premiumization-what-it-means-for-consumers-and-investors/

- MarketingCharts. (2023, December). More consumers say they’d pay a premium for trusted brands. MarketingCharts. Retrieved June 13, 2025, from https://www.marketingcharts.com/brand-related/brand-loyalty-231457

- Martuscello, J. (2021, June 12). Creating new customer value: Increasing pricing power with the 5 paths to premiumization. LinkedIn. Retrieved June 13, 2025, from https://www.linkedin.com/pulse/creating-new-customer-value-increasing-pricing-power-5-martuscello/

- Martuscello, J. (2020, October 1). How brands can bend the rules of pricing with premiumization. Quirk’s Marketing Research Media. Retrieved June 13, 2025, from https://www.quirks.com/articles/how-brands-can-bend-the-rules-of-pricing-with-premiumization

- NielsenIQ. (2016, December 15). Deeper than dollars: Global perceptions about premium products. NielsenIQ. Retrieved June 13, 2025, from https://nielseniq.com/global/en/insights/analysis/2016/deeper-than-dollars-global-perceptions-about-premium-products/

- PwC. (2024, May 15). Consumers willing to pay 9.7 % sustainability premium, even as cost-of-living and inflationary concerns weigh: PwC 2024 Voice of the Consumer Survey [Press release]. PwC. Retrieved June 13, 2025, from https://www.pwc.com/gx/en/news-room/press-releases/2024/pwc-2024-voice-of-consumer-survey.html

- Schmitt, C., Derr, T., Dhaliwal, V., & BenGoumi, M. (2024, October). Navigating FMCG pricing in a cost-of-living crisis. Oliver Wyman. Retrieved June 13, 2025, from https://www.oliverwyman.com/our-expertise/insights/2024/oct/effective-fmcg-pricing-strategies-for-cost-of-living-crisis.html

- Sosland, J. (2024, April 10). Baking industry explores top trends for brioche products. Supermarket Perimeter. Retrieved June 13, 2025, from https://www.supermarketperimeter.com/articles/11073-baking-industry-explores-top-trends-for-brioche-products