This thesis explores the trade potential between China and Kazakhstan within the Belt and Road Initiative (BRI) using a gravity model to analyze bilateral trade flows and their key determinants. It examines economic factors (GDP, population), infrastructure indicators (logistics and trade freedom), and geographic and institutional variables (distance, tariffs). The study identifies barriers such as tariffs, logistics inefficiencies, and certification issues, offering recommendations like infrastructure upgrades and streamlined cross-border procedures. Special focus is given to the mineral resources sector, highlighting its strategic role in trade through resource availability and investment in energy and transport. Combining theory and practical insights, the thesis provides valuable guidance for policymakers and stakeholders to enhance China-Kazakhstan trade and promote long-term economic cooperation.

Keywords: China-Kazakhstan trade, Belt and Road initiative, gravity model, bilateral trade potential, mineral resources, economic cooperation, trade barriers, infrastructure investment.

Research relevance

International trade is a key driver of global growth, with initiatives like China’s Belt and Road Initiative (BRI) reshaping trade dynamics. Kazakhstan and China’s growing partnership is central to this shift. Kazakhstan’s strategic location makes it a crucial transit hub between China, Europe, and Central Asia, while its vast natural resources—oil, gas, metals, and grain—align with China’s demand. In 2023, their trade turnover reached a record $41.06 billion, up 24 % from the previous year.

China is Kazakhstan’s top investor, supporting infrastructure, energy, and agriculture projects. Despite their geographic and economic complementarity, bilateral trade still has room to grow. The BRI aims to unlock this potential through expanded infrastructure and investment.

Given today’s mixed trade strategies, mathematical models help simplify analysis. The gravity model—based on economic size, distance, and trade barriers—offers a proven framework. Applied to BRI trade it shows how infrastructure boosts trade. Using this model for China–Kazakhstan trade reveals key dynamics and opportunities for deeper cooperation.

Literature review

The gravity model, inspired by Newton’s law, is widely used in international trade to assess bilateral flows based on GDP and distance. First applied empirically by Tinbergen (1962), it gained theoretical grounding through Anderson and Van Wincoop (2003), incorporating trade barriers and multilateral resistance [1] . Modern extensions include factors like free trade agreements, infrastructure, culture, and institutional quality.

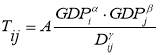

The basic gravity model formula:

where T ij represents the trade flow between countries i and j , GDP i and GDP j denote the gross domestic product of countries i and j , D ij is the distance between them, A is the free coefficient, and α, β, and γ are elasticity parameters. For analytical simplicity, the model is transformed into logarithmic form:

where ε ij represents the random error.

In the China–Kazakhstan context—especially under the Belt and Road Initiative (BRI)—the model is expanded to include logistics, political stability, and investment climate. Kazakhstan's strategic role as a transit hub and China’s major investments in its infrastructure shape this unique trade relationship.

Zhang et al. (2017) emphasize Kazakhstan’s trade role in Central Asia, noting regional cooperation and barriers [2]. Bedeladze & Belousova (2020) explore China’s integration with Kazakhstan under the Eurasian Economic Union (EAEU), highlighting geopolitical and investment impacts [3]. Beyer and Ruter (2015) show that free trade areas like NAFTA and the EU can boost trade by 40–50 % [4], while Li and Chen (2020) estimate that BRI-related infrastructure can raise trade in Central Asia by 25 % over a decade [5].

Several studies have applied gravity models to assess China's trade dynamics under the Belt and Road Initiative (BRI). Pogrebinskaya E. A. and Chen S. (2021) used a stochastic gravity model with GDP and distance to identify key factors influencing China’s trade [6]. Zhai Huafeng (2023) analyzed China-ASEAN trade, finding that GDP, distance, population, free trade agreements, and BRI participation positively impact trade, while per capita resources, exchange rates, and land area have minor negative effects [7].

Aksenov G., Li R., and Abbas Q. (2023) explored China-Russia trade, noting the influence of political alignment and shared international positions on future trade plans [8]. Meanwhile, Qiu B., Tian G., and Wang D. (2023) examined China's FTAs using an augmented gravity model, panel data, and PPML methods [9]. They found nine FTAs boosted trade and welfare, while five caused trade diversion. The study emphasized the need for continued trade liberalization to sustain growth.

Lu Feng’s (2023) study, “Economic Relations between China and Kazakhstan as Part of the Strategy 'Belt and Road Initiative' (Problems and Prospects),” explores the historical development, structure, and impact of BRI-related cooperation between the two countries. Using historical and comparative analysis, the research assesses the initiative’s economic, social, and legal effects on Kazakhstan and its role in Central Asia’s sustainable development [10].

Xiang et al. (2022) developed a six-factor model to assess mineral investment risk, with Kazakhstan ranked as a promising destination [11]. Gao et al. (2022) confirm Kazakhstan’s mineral potential but caution about regulatory and data-related risks [12].

Recent studies on China-Kazakhstan trade use gravity models to explore economic and geographic influences, trade complementarity, risks, and infrastructure impacts. However, most research overlooks Kazakhstan’s export dependence on Chinese mineral imports and related vulnerabilities.

This study fills gaps by analyzing sector-specific export dependence (2009–2023), incorporating extended gravity model variables such as political stability and logistics, and considering recent geopolitical and pandemic-related changes. This comprehensive approach offers novel insights and practical recommendations for sustainable and diversified trade development between Kazakhstan and China.

Purpose and objectives of the study

This study focuses on the impact of economic and geographic distance between China and Kazakhstan on bilateral trade and long-term mutual growth. Over the past 20 years, China and Kazakhstan have developed strong economic ties. While China's economic rise was driven by its coastal provinces.

Using the gravity model, which analyzes trade flows based on factors like GDP and distance, this study explores trade potential and challenges in China–Kazakhstan relations. It considers economic size, city-to-city distance, language, and tariffs to identify key trends and patterns in bilateral trade.

The study aims to:

– Identify trade potential between the two countries within the evolving Belt and Road Initiative (BRI) context;

– Assess BRI’s impact on bilateral trade and suggest policies for improvement;

– Identify financial and trade risks and propose precautionary measures to support stable cooperation.

Theoretical and practical significance

This study applies the gravity model to analyze Kazakhstan–China trade within the Belt and Road Initiative (BRI), highlighting how economic size and distance shape trade flows. It contributes to academic discourse by showing how geopolitical initiatives like BRI influence international trade, offering a framework applicable to similar global contexts.

Practical Significance:

– Policy Development: Provides insights for policymakers to strengthen economic cooperation under the BRI.

– Business Strategy: Helps companies optimize trade operations and identify new opportunities.

– Investment Planning: Assists investors in spotting high-potential areas for resource allocation.

– Infrastructure Focus: Identifies infrastructure needs critical to improving trade between the two countries.

In summary, the study combines theoretical modeling with practical recommendations to support trade, policy, and investment decisions in Kazakhstan–China relations.

Methodology

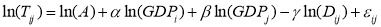

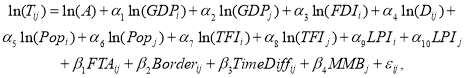

This study uses the Gravity Model to analyze bilateral trade between Kazakhstan and China within the framework of the Belt and Road Initiative (BRI). Widely applied in international economics, the Gravity Model explains trade flows based on countries’ economic size, distance, and other structural factors. In this context, the model is extended to include variables such as GDP, population, foreign direct investment (FDI), geographical distance, trade freedom index (TFI), logistics performance index (LPI), and institutional factors like the presence of free trade agreements (FTA), shared borders, and time zone differences.

The model’s core equation evaluates the trade volume (Tij) between two countries, considering how larger economies and closer geographical proximity enhance trade, while distance and institutional barriers reduce it. Variables such as FDI and infrastructure development under the BRI are shown to strengthen trade links, while trade freedom and logistics efficiency influence trade costs and reliability. Dummy variables like FTA, common borders, and time difference capture additional qualitative dimensions of bilateral trade.

To estimate the model, regression analysis is performed using Ordinary Least Squares (OLS). For panel data, both fixed-effects (FE) and random-effects (RE) models are tested, with the Hausman test guiding the appropriate choice. In cases involving zero trade flows or heteroscedasticity, the Poisson Pseudo Maximum Likelihood (PPML) method is used for more accurate results. STATA software facilitates the modeling process and supports diagnostic testing for reliability and accuracy.

This integrated analytical approach allows for a detailed assessment of trade dynamics between Kazakhstan and China, identifying key influencing factors and offering practical recommendations for enhancing bilateral trade through improved infrastructure, policy alignment, and deeper economic cooperation.

Justification for the selection of countries for analysis

The overland route of the «Belt and Road Initiative» (BRI) is a strategically significant direction connecting China with Eurasia and Europe through an extensive network of transport corridors. In the context of globalization and the development of global trade, this route stands out as an alternative to traditional maritime transport, offering reduced delivery times, more flexible logistics solutions, and strengthened economic ties among landlocked countries. The overland route is particularly important for Central Asia, which has historically served as a connecting link along the Silk Road and is now striving to revive this strategic position.

The countries selected for analysis play key roles within the route — Kazakhstan, Russia, Kyrgyzstan, Uzbekistan, Turkmenistan, Tajikistan, Armenia, Iran, Mongolia, Azerbaijan, Georgia, Belarus, Bulgaria, Turkiye, Poland, Romania, Serbia, Czech Republic and Hungary — were selected due to their strategic location along the overland Belt and Road Initiative route as key transit hubs and Germany, Italy and Netherlands as a final destination countries, and their growing trade volumes with China.

To assess trade feasibility between Kazakhstan and China, a gravity model was applied using key macroeconomic and structural variables that influence bilateral trade flows. This model analyzes how factors like GDP, population, distance, logistics, and institutional conditions affect trade volume, measured by trade turnover (combined exports and imports).

Core variables include the GDPs of both countries, population size, and distance, which reflect economic scale, demand, and transport costs. Foreign Direct Investment (FDI), log-transformed for elasticity interpretation, indicates deeper economic integration—especially relevant given China's infrastructure and energy investments in Kazakhstan.

Institutional and logistics quality are captured through the Trade Freedom Index (TFI) and Logistics Performance Index (LPI), which reflect trade policy openness and transport efficiency. Dummy variables represent the presence of Free Trade Agreements (FTA), a shared border, time zone differences, and participation in the Belt and Road Initiative (BRI), all of which influence trade flows.

The model was estimated using Ordinary Least Squares (OLS), with Poisson Pseudo Maximum Likelihood (PPML) used for robustness. Logarithmic transformation was applied to normalize variables and interpret results as elasticities. STATA software facilitated estimation and diagnostics (e.g., multicollinearity, heteroscedasticity).

This approach offers a detailed view of trade dynamics and identifies key factors driving Kazakhstan-China trade, supporting policy recommendations to strengthen economic cooperation.

Results and interpretation of the gravity model for countries on the overland route of the BRI

As part of this study, a gravity model of trade between China (source country) and 22 partner countries was constructed for the period from 2018 to 2023. The dependent variable in the model was trade turnover, while the independent variables included the following: China’s GDP (GDPi), GDP of partner countries (GDPj), population of the source and partner countries (POPi, POPj), imports from China (IMP_FR_CN), exports to China (EXP_TO_CN), foreign direct investment flows (FDI flow), trade freedom indices (TFIi, TFIj), logistics performance indices (LPIi, LPIj), the presence of free trade agreements (FTA), the presence of a common border (BORDER), time difference (TIMEDIFF), and membership in the Belt and Road Initiative (MMBi, MMBj).

To assess the factors influencing trade turnover between China and countries along the land route of the BRI, the gravity model was estimated using the Ordinary Least Squares (OLS) method.

The initial OLS regression analysis revealed a significant issue with multicollinearity between the variables GDPj and POPj. The Variance Inflation Factor (VIF) test indicated an exceptionally high VIF value for the variables ln_GDPj (40.85) and ln_POPj (17.47), which is a clear sign of substantial interdependence between these variables.

A correlation analysis further confirmed a strong linear relationship between GDP and the population of partner countries (correlation coefficient = 0.834) as well as between GDP and trade variables such as imports and exports.

To address this issue, several approaches were considered:

– Replacing the variables ln_GDPj and ln_POPj with GDP per capita.

– Mean centering the variables.

– Applying Principal Component Analysis (PCA).

However, none of these methods — including GDP per capita substitution, mean centering, or PCA — produced satisfactory results. Following the application of these techniques, the significance of several key variables declined considerably, and the model lost both its explanatory power and economic interpretability.

Table 1

Ordinary Least Squares regression results

|

Trade turnover |

Coefficient |

Std. err. |

t |

P>|t| |

[95 % conf. interval] | |

|

GDPi |

.4479811 |

.289157 |

1.55 |

0.124 |

-.1246793 |

1.020641 |

|

GDPj |

.7248024 |

.0294285 |

24.63 |

0.000 |

.6665209 |

.7830839 |

|

Import share |

.0163665 |

.0018233 |

8.98 |

0.000 |

.0127555 |

.0199775 |

|

Export share |

.0310408 |

.0029535 |

10.51 |

0.000 |

.0251914 |

.0368901 |

|

FDI flow |

.0394769 |

.0167297 |

2.36 |

0.020 |

.0063446 |

.0726091 |

|

D |

-.5241597 |

.1213381 |

-4.32 |

0.000 |

-.7644636 |

-.2838559 |

|

TFIi |

.2271032 |

2.926455 |

0.08 |

0.938 |

-5.568589 |

6.022795 |

|

TFIj |

-.8695978 |

.3393989 |

-2.56 |

0.012 |

-1.54176 |

-.1974359 |

|

LPIi |

1.020711 |

3.761882 |

0.27 |

0.787 |

-6.429499 |

8.470921 |

|

LPIj |

2.356511 |

.3741664 |

6.30 |

0.000 |

1.615494 |

3.097528 |

|

FTA |

.1411425 |

.0715968 |

1.97 |

0.051 |

-.0006512 |

.2829361 |

|

BORDER |

.2655345 |

.1274144 |

2.08 |

0.039 |

.0131969 |

.5178721 |

|

TIME DIFF |

-.0280293 |

.0886049 |

-0.32 |

0.752 |

-.2035066 |

.147448 |

|

MMBj |

-.4983659 |

.0836729 |

-5.96 |

0.000 |

-.6640757 |

-.3326561 |

As a result, it was decided to exclude the variables representing the population of the source and partner countries (POPi and POPj), which led to a significant improvement in the model’s quality. Additionally, the variables imports and exports were replaced with their respective shares of GDP. After excluding the population variables and introducing the new variables import_share and export_share, the VIF indicator normalized, with an average VIF value of 3.13, and the significance of most variables improved considerably. Consequently, a revised OLS regression was performed (Table 1]).

China’s GDP (ln_GDPi) showed a positive but statistically insignificant relationship with trade turnover (coefficient = 0.4479; p = 0.124), suggesting limited short-term impact due to China’s stable economy. In contrast, partner countries’ GDP (ln_GDPj) had a strong positive and significant effect (0.7248; p = 0.000), supporting the gravity model’s view that larger economies trade more.

Import and export shares relative to partner GDPs were both positive and highly significant (0.0163 and 0.0310; p < 0.001), showing that countries more open to trade are more active with China. Chinese FDI (ln_FDI_flow) had a small but significant effect (0.0394; p = 0.020), suggesting investment promotes trade by improving infrastructure.

Distance (ln_D) had a significant negative impact (-0.5242; p = 0.000), consistent with gravity model expectations. The Trade Freedom Index for partner countries (ln_TFIj) was negatively significant (-0.8696; p = 0.012), implying that more restrictive trade policies reduce trade with China.

Logistics performance in partner countries (ln_LPIj) was a strong positive factor (2.3565; p = 0.000), while China's own LPI and TFI were insignificant. Free Trade Agreements (FTA) had a borderline positive effect (0.1411; p = 0.051), and shared borders (BORDER) significantly boosted trade (0.2655; p = 0.039). Time difference (TIMEDIFF) was not significant (p = 0.752).

Interestingly, BRI membership (MMBj) had a negative impact (-0.4984; p = 0.000), likely reflecting the delayed benefits of ongoing infrastructure projects. The Breusch-Pagan test confirmed homoscedasticity (p = 0.9015), indicating the model is stable and reliable.

To ensure the model’s results are as accurate and trustworthy as possible, further assessments were carried out using both the Fixed Effects (FE) and Random Effects (RE) models. This method helps adjust standard errors and account for possible connections between observations within the same country. This step further improved the reliability and accuracy of the model’s findings.

Table 2

Fixed Effects model results

|

Trade turnover |

Coefficient |

Std. err. |

t |

P>|t| |

[95 % conf. interval] | |

|

GDPi |

1.225413 |

.3406624 |

3.60 |

0.001 |

.5493799 |

1.901447 |

|

GDPj |

.0643985 |

.2426533 |

0.27 |

0.791 |

-.4171391 |

.5459361 |

|

Import share |

.0158073 |

.0023819 |

6.64 |

0.000 |

.0110805 |

.020534 |

|

Export share |

.0250712 |

.0048745 |

5.14 |

0.000 |

.0153979 |

.0347445 |

|

FDI flow |

.0058394 |

.0164646 |

0.35 |

0.724 |

-.0268341 |

.038513 |

|

D |

-54.6983 |

219.5906 |

-0.25 |

0.804 |

-490.4686 |

381.072 |

|

TFIi |

3.773467 |

2.207933 |

1.71 |

0.091 |

-.6081035 |

8.155038 |

|

TFIj |

-.2827572 |

.4585519 |

-0.62 |

0.539 |

-1.192739 |

.6272242 |

|

LPIi |

3.659228 |

2.597764 |

1.41 |

0.162 |

-1.495951 |

8.814407 |

|

LPIj |

2.085201 |

.6222315 |

3.35 |

0.001 |

.8504029 |

3.319999 |

|

FTA |

.1105619 |

.0798127 |

1.39 |

0.169 |

-.0478239 |

.2689477 |

|

BORDER |

0 |

(omitted) | ||||

|

TIMEDIFF |

0 |

(omitted) | ||||

|

MMBj |

.0073739 |

.205999 |

0.04 |

0.972 |

-.4014245 |

.4161722 |

The FE model results showed that variables such as China’s GDP (ln_GDPi), distance (ln_D), China’s Trade Freedom Index (ln_TFIi), and the FTA dummy were statistically significant (Table 2). A positive coefficient for ln_GDPi (1.225) indicates that China's economic growth positively affects trade turnover. The negative coefficient for ln_D (-0.5889) supports the gravity model, where greater distance reduces trade. Export and import shares also had significant effects, reinforcing their role in influencing trade volumes.

In contrast, variables like logistics performance (LPI), trade freedom (TFI) of partner countries, FDI, BORDER, TIMEDIFF, and BRI membership (MMBj) were not significant in the FE model.

Table 3

Random Effects model results

|

Trade turnover |

Coefficient |

Std. err. |

z |

P>|z| |

[95 % conf. interval] | ||

|

GDPi |

.5051655 |

.2182751 |

2.31 |

0.021 |

.0773543 |

.9329768 | |

|

GDPj |

.7307872 |

.0513899 |

14.22 |

0.000 |

.6300648 |

.8315096 | |

|

Import share |

.0149878 |

.0021021 |

7.13 |

0.000 |

.0108678 |

.0191078 | |

|

Export share |

.0273695 |

.0041249 |

6.64 |

0.000 |

.0192849 |

.0354542 | |

|

FDI flow |

.0081413 |

.0159269 |

0.51 |

0.609 |

-.0230749 |

.0393576 | |

|

D |

-.5874923 |

.2706037 |

-2.17 |

0.030 |

-1.117866 |

-.0571188 | |

|

TFIi |

.5939602 |

2.016001 |

0.29 |

0.768 |

-3.357328 |

4.545249 | |

|

TFIj |

-.6484109 |

.4034699 |

-1.61 |

0.108 |

-1.439197 |

.1423755 | |

|

LPIi |

1.485887 |

2.546944 |

0.58 |

0.560 |

-3.506032 |

6.477805 | |

|

LPIj |

2.364277 |

.5037835 |

4.69 |

0.000 |

1.37688 |

3.351675 | |

|

FTA |

.1005797 |

.0763194 |

1.32 |

0.188 |

-.0490036 |

.2501629 | |

|

BORDER |

.2903838 |

.2870986 |

1.01 |

0.312 |

-.2723191 |

.8530868 | |

|

TIMEDIFF |

-.0430497 |

.2100859 |

-0.20 |

0.838 |

-.4548106 |

.3687112 | |

|

MMBj |

-.2679399 |

.1476887 |

-1.81 |

0.070 |

-.5574044 |

.0215246 | |

The RE model confirmed the significance of China’s GDP, partner countries' GDP (ln_GDPj = 0.7308), import_share (-0.419), export_share (0.027), and imports from China (ln_imp_fr_ch = 0.4402) (Table 3). However, variables related to population, institutions, and distance were not significant in this model.

A Hausman test was conducted to compare the FE and RE models. The results (Chi²(7) = 15.49, p = 0.0302) indicated systematic differences between them. Since the p-value is below 0.05, the null hypothesis is rejected, and the FE model is preferred. It provides more reliable estimates by capturing unobserved country-specific factors and better reflecting cross-country differences.

After applying OLS, FE, and RE models and conducting the Hausman test, a PPML (Poisson Pseudo Maximum Likelihood) analysis was performed to ensure result stability, especially given possible heteroscedasticity and zero trade values. PPML is well-suited for gravity models as it handles heteroscedasticity and zero trade flows more effectively than traditional methods.

Table 4

Poisson Pseudo Maximum Likelihood test results

|

Robust | ||||||

|

Trade turnover |

Coefficient |

std. err. |

z |

P>|z| |

[95 % conf. interval] | |

|

GDPi |

.1677882 |

.1606032 |

1.04 |

0.296 |

-.1469884 |

.4825647 |

|

GDPj |

.4134457 |

.1576687 |

2.62 |

0.009 |

.1044208 |

.7224706 |

|

Import share |

.0076035 |

.0014041 |

5.42 |

0.000 |

.0048516 |

.0103555 |

|

Export share |

.0110111 |

.0027968 |

3.94 |

0.000 |

.0055294 |

.0164928 |

|

FDI flow |

.0064738 |

.0075128 |

0.86 |

0.389 |

-.008251 |

.0211985 |

|

D |

0 |

(omitted) | ||||

|

TFIi |

.2015873 |

.8622175 |

0.23 |

0.815 |

-1.488328 |

1.891502 |

|

TFIj |

-.1985884 |

.2835507 |

-0.70 |

0.484 |

-.7543376 |

.3571608 |

|

LPIi |

.7460124 |

1.614572 |

0.46 |

0.644 |

-2.41849 |

3.910515 |

|

LPIj |

1.267568 |

.3854342 |

3.29 |

0.001 |

.512131 |

2.023005 |

|

FTA |

.0541676 |

.0608243 |

0.89 |

0.373 |

-.0650457 |

.173381 |

|

MMBj |

.0178528 |

.0243323 |

0.73 |

0.463 |

-.0298378 |

.0655433 |

The PPML results showed that China’s GDP (GDPi) was not statistically significant (p = 0.296), while the GDP of partner countries (GDPj) had a positive and significant effect (coefficient = 0.4134; p = 0.009) (Table 4). This means that a 1 % increase in a partner’s GDP raises trade turnover by about 0.41 %, confirming the importance of economic size in trade.

Logistics performance in partner countries (ln_LPIj) also had a strong, positive impact (p = 0.001), highlighting the role of infrastructure. Both import and export shares relative to GDP were statistically significant (p < 0.001), showing that stronger trade ties increase overall turnover. A 1 % rise in import share raises trade by 0.0076 %, and a 1 % rise in export share by 0.011 %.

The distance variable (ln_D) was excluded due to multicollinearity, which is common in PPML models with time-invariant variables. Other variables — FDI, trade freedom (TFI), China’s logistics (ln_LPIi), FTA, and BRI membership (MMBj) — were not significant (p > 0.1), suggesting their limited or unclear impact in this context.

Overall, the PPML analysis confirmed the significance of economic size and trade intensity, supporting the robustness of key relationships identified earlier. These results strengthen the model’s reliability and complete the econometric analysis stage of the gravity model.

Analysis of trade in mineral resources between Kazakhstan and China

Kazakhstan–China trade and economic cooperation is a strategic priority due to several key factors. Kazakhstan's location makes it a central transit hub between China, Europe, and Central Asia, especially within the Belt and Road Initiative (BRI), boosting trade and investment. Kazakhstan’s rich reserves of oil, gas, and metals also make it a vital supplier for resource-hungry China.

China is one of the largest foreign investors in Kazakhstan, mainly in oil and gas, energy, transport, and agriculture. In 2023, bilateral trade reached a record $41.06 billion—a 24 % increase from the previous year. Mineral resource trade is the backbone of this relationship, accounting for over 70–90 % of Kazakhstan’s exports to China. Major exports include oil, gas, metals (copper, zinc, chromium), and uranium, while imports are mainly machinery, chemicals, and equipment.

Kazakhstan’s main oil and gas projects—Kashagan, Tengiz, and Karachaganak—are geared toward meeting China’s growing energy demand. The complementarity of China’s need for raw materials and Kazakhstan’s resource wealth strengthens mutual energy security and fuels economic development.

Within the BRI framework, large-scale energy and infrastructure projects have deepened bilateral ties. The Atasu–Alashankou and Kenkiyak–Kumkol oil pipelines provide direct oil routes to China, reducing reliance on Russian transit. The Beineu–Bozoi–Shymkent gas pipeline also boosts gas exports, with 10 billion m³ sent to China annually.

Refinery upgrades in Shymkent, Pavlodar, and Atyrau have improved product quality and refining capacity by 20 %. From 2013–2020, China invested $18.5 billion in Kazakhstan under BRI, including $3.8 billion in transport. Projects like “Western Europe–Western China” and Khorgos logistics hubs cut transport costs and delivery times by up to 35 %.

By expanding pipelines, refineries, and trade routes, Kazakhstan has strengthened its role as a key energy supplier to China and a vital link in regional trade networks.

To analyze mineral resource trade between Kazakhstan and China, this study applies the gravity model of international trade, which is widely used to assess and forecast bilateral trade flows based on economic and institutional factors.

The model includes several key variables:

– GDP per capita (GDPi_capita and GDPj_capita): Replaces total GDP and population to avoid multicollinearity and better reflect economic development and purchasing power.

– FDI: Measures Chinese direct investment in Kazakhstan’s extractive industries, reflecting its role in supporting bilateral mineral trade.

– MIN_EXP: Represents the volume of Kazakhstan’s mineral exports to China, allowing direct assessment of raw material trade impact.

– RES_DEP: Shows Kazakhstan’s dependence on mineral resource exports to China as a percentage of total exports, highlighting potential risks of over-reliance.

– PSI ij (Political Stability Index): Reflects the influence of political stability on trade and long-term investment decisions.

– LPI ij (Logistics Performance Index): Assesses infrastructure quality and its effect on trade efficiency.

– TFI ij (Trade Freedom Index): Captures the level of trade liberalization and presence of trade barriers.

Classical gravity variables such as distance and shared borders were excluded due to their invariance over time.

Results and interpretation of the gravity model for mineral resource trade

To examine the factors influencing mineral resource trade between Kazakhstan and China, an OLS regression was conducted using the log of trade turnover as the dependent variable. Independent variables included economic, political, and infrastructural indicators, as well as resource-specific measures (Table 5).

Table 5

OLS-regression analysis of mineral resources

|

Trade tunrover |

Coefficient |

Std. err. |

t |

P>|t| |

[95 % conf. interval] | |

|

GDPj capita |

.1080048 |

.0329398 |

3.28 |

0.082 |

-.0337237 |

.2497333 |

|

GDPi capita |

.2952418 |

.0210466 |

14.03 |

0.005 |

.2046857 |

.3857978 |

|

FDI |

-.0516802 |

.0163539 |

-3.16 |

0.087 |

-.1220455 |

.018685 |

|

Mineral export |

.7741345 |

.0156909 |

49.34 |

0.000 |

.7066218 |

.8416472 |

|

Resource dependence |

-.5131593 |

.0581204 |

-8.83 |

0.013 |

-.7632311 |

-.2630874 |

|

PSIi |

.0803358 |

.0242118 |

3.32 |

0.080 |

-.0238391 |

.1845108 |

|

PSIj LPIi |

.3546562 .4578922 |

.0190439 .0210472 |

18.62 19.21 |

0.003 0.006 |

.2727168 .3541729 |

.4365956 .5582146 |

|

LPIj |

-.8070907 |

.0424675 |

-19.00 |

0.003 |

-.9898137 |

-.6243677 |

|

TFIi |

5.153394 |

.2481197 |

20.77 |

0.002 |

4.085821 |

6.220967 |

|

TFIj |

-1.254034 |

.1608008 |

-7.80 |

0.016 |

-1.945904 |

-.5621647 |

|

FTA |

.0906273 |

.0107437 |

8.44 |

0.014 |

.0444007 |

.1368539 |

|

MMBi |

.0155243 |

.0143664 |

1.08 |

0.003 |

.0773381 |

.0462895 |

|

MMBj |

0 |

(omitted) | ||||

Key Findings:

– GDP per capita for both China (coef. 0.295, p = 0.005) and Kazakhstan (coef. 0.108, p = 0.082) had a positive impact, indicating that higher economic development boosts trade. China's stronger effect reflects its role as the main consumer.

– FDI from China showed a negative effect (coef. -0.052, p = 0.087), possibly due to long-term investment horizons rather than immediate trade impact.

– Mineral exports from Kazakhstan had a strong positive effect (coef. 0.774, p = 0.000), confirming their central role in trade.

– Export dependence on minerals (RES_DEP) was negative (coef. -0.513, p = 0.013), suggesting risks of over-reliance, consistent with the “Dutch Disease” phenomenon.

– Political Stability in Kazakhstan had a significant positive effect (coef. 0.354, p = 0.003), fostering trade through reduced risk and improved cooperation. China's stability (coef. 0.080, p = 0.080) had a lesser effect due to its already stable environment.

– Logistics Performance Index (LPI): Kazakhstan’s LPI had a negative effect (coef. -0.807, p = 0.003), pointing to infrastructure inefficiencies. China’s LPI was positive (coef. 0.458, p = 0.006), highlighting its strong logistics network.

– Trade Freedom Index (TFI): Kazakhstan’s TFI showed a positive effect (coef. 5.153, p = 0.002), while China’s TFI was negative (coef. -1.254, p = 0.016), reflecting non-tariff barriers and regulatory restrictions.

– FTA dummy was positive and significant (coef. 0.090, p = 0.014), confirming the importance of institutional agreements like the EAEU-China agreement and BRI projects.

Diagnostic Tests:

– Durbin-Watson (2.97) and Breusch-Godfrey test (p = 0.0006) indicated negative autocorrelation in residuals.

– A revised regression with robust standard errors was applied to address issues of autocorrelation and heteroscedasticity, yielding more reliable estimates.

The analysis confirms that economic development, political stability, logistics, and institutional arrangements significantly affect mineral trade between Kazakhstan and China. However, over-dependence on raw material exports and trade barriers on the Chinese side remain major constraints. The use of robust standard errors ensured credible results despite diagnostic issues.

Applying robust standard errors improved the reliability of the gravity model results and revealed several new insights into China–Kazakhstan mineral trade. Notably, Kazakhstan’s GDP per capita became more statistically significant (p = 0.004), confirming the role of the exporter’s economic strength. China's GDP per capita also gained slightly stronger significance (p = 0.055), suggesting rising demand due to its economic growth (Table 6).

A key change was the confirmation of a significant negative effect of China’s FDI in Kazakhstan (p = 0.009). This may be due to Chinese firms investing in local mineral extraction and using resources domestically, reducing the need for imports. The central variable — mineral exports from Kazakhstan — remained highly significant (p = 0.000), as did the export dependence on minerals (p = 0.008), highlighting the sector’s importance in bilateral trade.

Table 6

OLS-regression with robust standard errors analysis of mineral resources

|

Robust | ||||||

|

Trade turnover |

Coefficient |

std. err. |

t |

P>|t| |

[95 % conf. interval] | |

|

GDPj capita |

.1080048 |

.0264486 |

4.08 |

0.055 |

-.0057943 |

.2218039 |

|

GDPi capita |

.2952418 |

.0189142 |

15.61 |

0.004 |

.2138604 |

.3766231 |

|

FDI |

-.0516802 |

.0049159 |

-10.51 |

0.009 |

-.0728315 |

-.0305289 |

|

Mineral export |

.7741345 |

.0099561 |

77.75 |

0.000 |

.7312967 |

.8169723 |

|

Resource dependence |

-.5131593 |

.0447401 |

-11.47 |

0.008 |

-.7056605 |

-.320658 |

|

PSIi |

.0803358 |

.0270018 |

2.98 |

0.097 |

-.0358435 |

.1965152 |

|

PSIj LPIi |

.3546562 .4781152 |

.0166613 .0215475 |

21.29 24.11 |

0.002 0.003 |

.2829684 .3317135 |

.426344 .489934 |

|

LPIj |

-.8070907 |

.0242005 |

-33.35 |

0.001 |

-.9112172 |

-.7029642 |

|

TFIi |

5.153394 |

.1722594 |

29.92 |

0.001 |

4.412222 |

5.894567 |

|

TFIj |

-1.254034 |

.157935 |

-7.94 |

0.015 |

-1.933574 |

-.5744949 |

|

FTA |

.0906273 |

.0097311 |

9.31 |

0.011 |

.0487579 |

.1324967 |

|

MMBi |

-.0155243 |

.0092403 |

-1.68 |

0.235 |

-.0552821 |

.0242335 |

|

MMBj |

0 |

(omitted) | ||||

Institutional and infrastructural factors became more prominent. The Logistics Performance Index (LPIj) and the Trade Freedom Index (TFIj) were both significant at the 1 % level. Higher LPI scores, linked to better customs, infrastructure, and tracking, were associated with increased trade. Kazakhstan should focus on improving logistics coordination, especially in hubs like Khorgos and Dostyk, through digital platforms, intermodal centers, and harmonized railway standards.

Although TFIj was statistically significant, its negative coefficient suggests that non-tariff barriers still hinder trade, despite formal liberalization. Recommendations include simplifying export licensing and negotiating mutual recognition agreements with China for mineral standards.

Finally, the FTA dummy became significant (p = 0.011), highlighting the importance of formal agreements in enabling trade, especially in infrastructure projects like the Kazakhstan–China pipeline.

Overall, the robustness-adjusted model enhances the credibility of the findings and strengthens policy recommendations. It points to specific areas — logistics, trade procedures, and investment policy — where reforms can maximize trade efficiency and promote sustainable economic ties.

Conclusion and future study

This study presents a detailed analysis of China–Kazakhstan bilateral trade under the Belt and Road Initiative (BRI) using an extended gravity model. It focuses on overall economic interactions along the BRI route, with special attention to the trade of mineral resources between the two countries.

During the research process, several challenges emerged, particularly in data collection. Accessing reliable indicators like FDI flows and trade freedom indices proved difficult, especially for Central Asian countries. These limitations required extensive cross-checking with international databases to ensure data quality.

Despite these issues, the findings clearly identify key determinants of bilateral trade. Economic size (measured by GDP per capita) consistently had a positive effect on trade flows, while efficient logistics and quality infrastructure were critical enablers. Conversely, physical distance and trade restrictions remained obstacles, highlighting the importance of reducing barriers and improving connectivity.

Mineral exports emerged as a strategic component of Kazakhstan's trade with China. The results emphasize the critical role of infrastructure projects and joint ventures in promoting mutual economic growth. The model demonstrates that trade in minerals significantly affects Kazakhstan’s economy and strengthens its ties with China.

Several policy implications arise from this research. First, continued investment in infrastructure—especially in transport and logistics—is essential for improving trade efficiency. Second, reducing trade barriers and expanding FTAs can lower transaction costs and support deeper integration. Third, promoting energy cooperation and joint resource projects is key to long-term economic collaboration. Policymakers should prioritize simplifying customs procedures, harmonizing trade standards, and deepening regional cooperation under the BRI framework.

Future research could broaden this analysis by incorporating political, environmental, and technological dimensions. For instance, integrating geopolitical risk indices would help assess how regional instability, diplomatic shifts, or sanctions impact trade. Similarly, studying the effects of climate change on transport infrastructure and the push for decarbonization could reveal sustainability risks and opportunities in the mineral sector.

Another important direction is examining sustainable development practices in resource extraction, including environmental standards, CSR, and green finance. These factors increasingly influence investor decisions and market access. Additionally, exploring the role of digital trade—such as e-commerce, blockchain for customs, and digital logistics tracking—could uncover how innovation supports transparency, reduces costs, and enhances trade integration between China and Kazakhstan.

In conclusion, this thesis contributes both theoretically and practically to the understanding of international trade under large-scale initiatives like the BRI. The use of an enhanced gravity model—combining traditional factors like GDP and distance with institutional and infrastructural indicators like TFI, LPI, and FTA—offers deeper insight into modern trade flows, especially for resource-dependent economies.

Practically, the study provides empirical evidence on China–Kazakhstan trade interdependence in the mineral sector, offering value to policymakers, investors, and researchers. It highlights the need for sustained investment, better logistics coordination, and more effective trade facilitation to support long-term growth. By identifying both strengths and challenges in the current trade relationship, the thesis offers a roadmap for building more integrated, resilient, and sustainable partnerships across the broader BRI region.

References:

- Anderson J. E., van Wincoop E. (2003). Gravity with Gravitas: A Solution to the Border Puzzle [J]. American Economic Review,, 63: 881–892.

- Zhang W., Wu Q., Shi H. (2017). Study on Trade Complementarity and Trade Potential between China and Kazakhstan in the Background of “One Belt and One Road” [J]. International Journal of Science and Research, 6(3): 116–128. https://ijsr.net/archive/v6i3/ART20171300.

- Bedeladze D. S., Belousova D. V. (2020). Trade and economic cooperation of the Republic of Kazakhstan with China and its impact on the development of integration in the EAEU format [J]. Post-Soviet Studies, 3(2).

- Beyer P. H., Ruter A. P. (2018). The impact of membership in free trade areas on trade flows (J). SSRN Electronic Journal.

- Li E., Lu M., Chen Y. (2020). Analysis of China’s Importance in “Belt and Road Initiative” Trade Based on a Gravity Model [J]. Sustainability, 12(17): 6808. https://doi.org/10.3390/su12176808.

- Pogrebinskaya E. A., Chen S. (2021). Analysis of the economic relations potential between China and other countries within the One Belt, One Road initiative based on the stochastic border trade gravity model [J]. High-tech enterprises economy. ISSN 2542–0593.

- Zhai H. (2023). Evaluation of China-ASEAN trade status and trade potential: An empirical study based on a gravity model [J]. PLoS ONE, 18(9): e0290897. https://doi.org/10.1371/journal.pone.0290897.

- Aksenov G., Li R., Abbas Q. (2023). Development of Trade and Financial-Economical Relationships between China and Russia: A Study Based on the Trade Gravity Model [J]. Sustainability (Switzerland), 15(7). https://doi.org/10.3390/su15076099.

- Qiu B., Tian G., Wang D. (2023). Empirical Analysis of Sustainable Trade Effects of FTAs Based on Augmented Gravity Model: A Case Study of China [J]. Sustainability (Switzerland), 15(1). https://doi.org/10.3390/su15010269.

- Lu F. (2023). Economic Relations between China and Kazakhstan as Part of the Strategy «One Belt — One Road» (Problems and Prospects) [J]. Russia in the Global World, Vol. 26(3): 58–77. DOI: 10.48612/rg/RGW.26.3.5

- Xiang Y., Zhang Q., Wang D., et al. (2022). Mining Investment Risk Assessment for Nations along the Belt and Road Initiative [J]. Land, 11(8). https://doi.org/10.3390/land1108128.

- Gao Y., Liu M., Zhang D., et al. (2022). Characteristics of Main Mineral Resources and Mining Investment Environment in Kazakhstan [J]. Geology and Exploration, 58(2): 454–464. https://doi.org/10.12134/j.dzykt.2022.02.019.